Six out of ten users of online commerce use BNPL (Buy now, pay later) as a payment option. The user base is expanding and is expected to be as massive as 360 million by 2027. Making BNPL a payment option too important to be ignored for any online business, which obviously includes online travel businesses.

The market trends and consumer interests are evident, and the online travel industry has to catch up to this trend. As an online travel business, what should be your BNPL approach? If you are inclined to implement it, what are your options? In this piece, we will address these questions in greater detail.

Understanding BNPL and how it works for businesses

Buy Now, customers can split their payments into multiple, often interest-free installments. This deferred payment option is a game-changer for businesses as it attracts a broader customer base and encourages higher-value purchases.

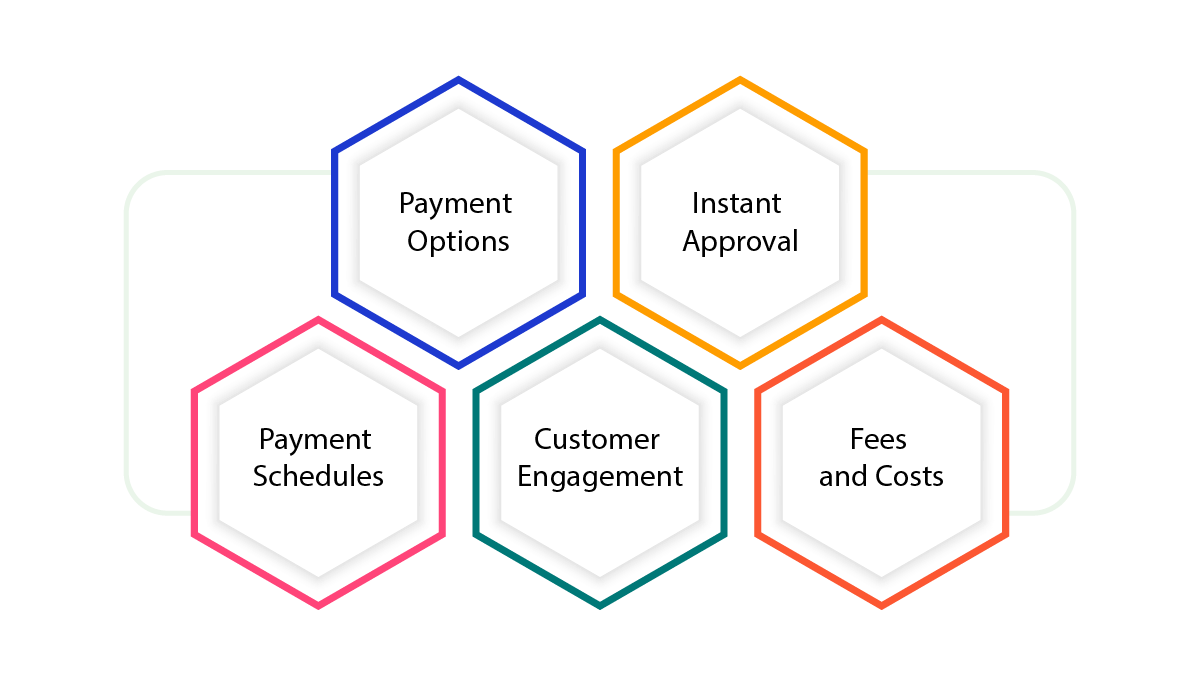

For online businesses, BNPL offers several advantages. It can increase the average order value, reduce cart abandonment rates, and attract a wider demographic by providing flexible payment terms. Importantly, BNPL companies bear the risk of customer defaults, making it a risk mitigation strategy for businesses despite the apparent benefits. BNPL services typically work as follows for companies:

- Payment Options: Once integrated, BNPL becomes one of the payment options available to customers during checkout. Customers can select BNPL as their preferred method when they reach the payment stage.

- Instant Approval: BNPL providers often perform a quick credit check or assess the customer’s financial health in real time. This approval process can take just a few seconds, and eligible customers can proceed with their purchase.

- Payment Schedules: Customers can choose how to spread their payments – commonly into 4 or 6 equal installments. These installments are billed automatically over several weeks or months.

- Customer Engagement: BNPL services improve customer engagement by providing a more affordable way to purchase products or services. This can lead to higher customer loyalty and repeat business.

- Fees and Costs: BNPL providers often charge companies a fee for using their services, usually a percentage of the transaction amount. However, this fee is offset by the increased sales and customer retention.

BNPL implementation in online travel companies

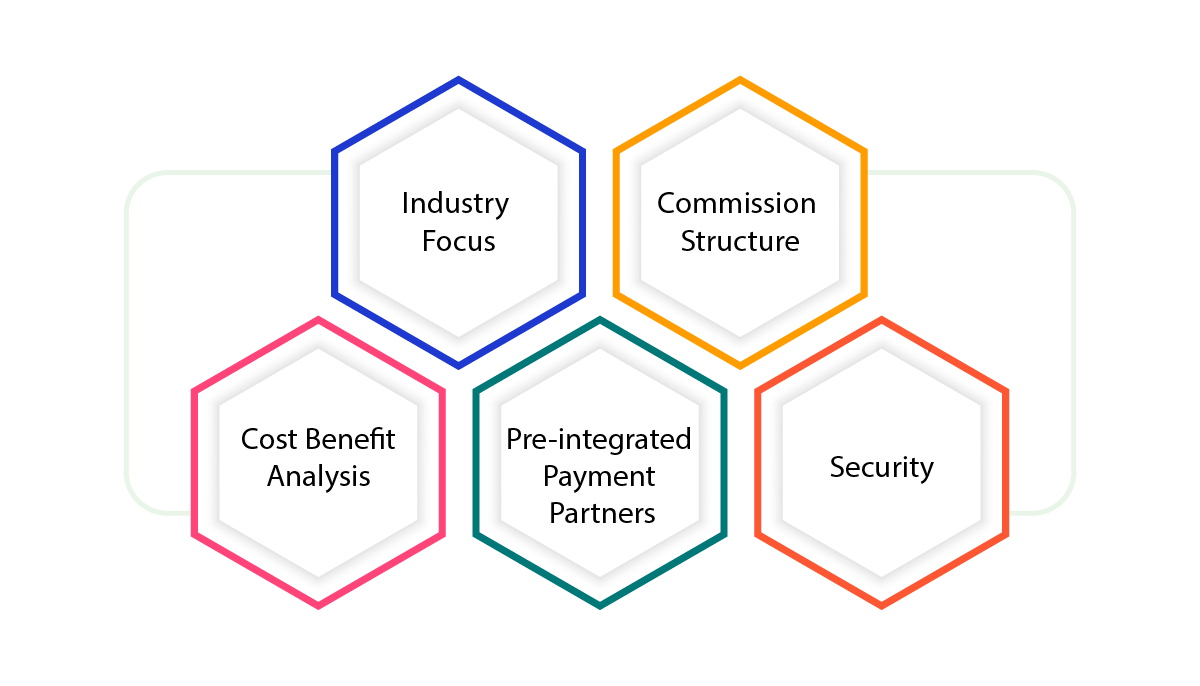

Selecting the correct Buy Now, Pay Later provider is the first step towards making this decision a success for your online travel business. Here are vital factors to consider when making this choice:

- Industry Focus: Some BNPL providers, like Klarna or Affirm, serve multiple industries, while others, such as Fly Now Pay Later, focus exclusively on the travel sector. Consider whether you prefer a provider specialized in travel or one with a broader industry reach.

- Commission Structure: Understand the two main commission structures – merchant transaction fee loans and shopper interest loans. Merchant transaction fee loans involve paying a commission to the BNPL provider, usually a percentage of the purchase amount. Shopper interest loans mean customers pay interest, but you don’t pay commissions. Evaluate which structure aligns with your business goals and customer base.

- Cost Benefit Analysis: BNPL fees can be higher than those for credit card transactions. Carefully examine the fee structure and consider the cost of customer acquisition and increasing sales volume. Some providers may not charge merchants, which is worth considering.

- Pre-integrated Payment Partners: Ensure your chosen BNPL provider seamlessly integrates with your payment processing solution. Using payment technology like Stripe, prioritize providers with existing integrations to streamline the implementation process.

- Security: Fraud is a concern in financial matters, including BNPL. Opt for reputable BNPL lenders with robust security procedures, fraud checks, and customer vetting processes. Ensure that your own online payment solution maintains a high level of security to prevent fraudulent activity.

Choosing a Partnership Model

- Merchant-Partner Model: This common approach involves integrating the BNPL payment option into your website’s checkout process. While widely used, it may require effort to adapt your existing checkout flow to accommodate the new payment functionality.

- BNPL App Model: In this model, the BNPL provider includes your travel products in their app, creating a virtual shopping mall. Users can access and purchase products, including travel offerings, through the app. Some providers redirect shoppers to your website, while others enable in-app bookings. This model is suitable for businesses with a diverse range of products, but for travel businesses, the merchant-partner model is often preferable.

Applying for Partnership

Once you’ve identified a suitable BNPL partner, you must complete an application providing basic information about your company. Most BNPL providers have vetting procedures for merchants to ensure compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

BNPL is no longer just a fad. It’s an avenue that can significantly help your online travel business increase the bottom line. Implementation complexity depends on your chosen partnership model and the preexisting compatibility with your payment technology. If you opt for the merchant-partner model, be prepared for the possibility of building an integration from scratch. Most BNPL providers offer open APIs to link to your payment system. If you showcase your travel inventory in their app, some providers will handle the integration themselves.