Before the advent of the internet, vacation trips were basically planned by travel agents. The traveler would have to flip through travel brochures, talk to an expert travel agent for affordable hotel rates and discounts and the travel agent would offer a gleaming holiday package at a discounted rate. Fast forward to the 1990s and early 2000s, the world witnessed the boom of online travel agencies like Expedia, Booking.com, and TripAdvisor which helped consumers buy travel products online. The online travel shopping experience turned out to be a megahit and everyone wanted a share in this lucrative business market. The OTA market quickly proliferated with several new companies with unique business models.

Noticing the skyrocketing success of OTAs, Google, the search powerhouse, dipped its toes into the online travel market in the early 2010s. The company acquired ITA Software, a Cambridge flight information software company, for $700 million to help users find better flight information. Since then, Google has launched several travel-related products, such as Google Flights, Google Hotel Search, Google Hotel Ads, and a vacation-rental metasearch platform for smarter travel planning. So does Google plan to enter the OTA market in the coming years? Let’s decode that in the following sections.

Google the Disruptor of the Online Travel Agency Market

Clearly, Google has been trying to disrupt the online travel agency model, which is currently ruled by Booking.com, Expedia, and TripAdvisor. According to a Hootsuite study, Google controls 92.58% of the global search engine market, helping the digital consumer in the five phases of their journey- dreaming, planning, booking, experiencing, and sharing. While the search engine is not an OTA yet, it clearly is edging in that direction by making search relevant, easy, and quick for travel planners. Let’s understand this with an example.

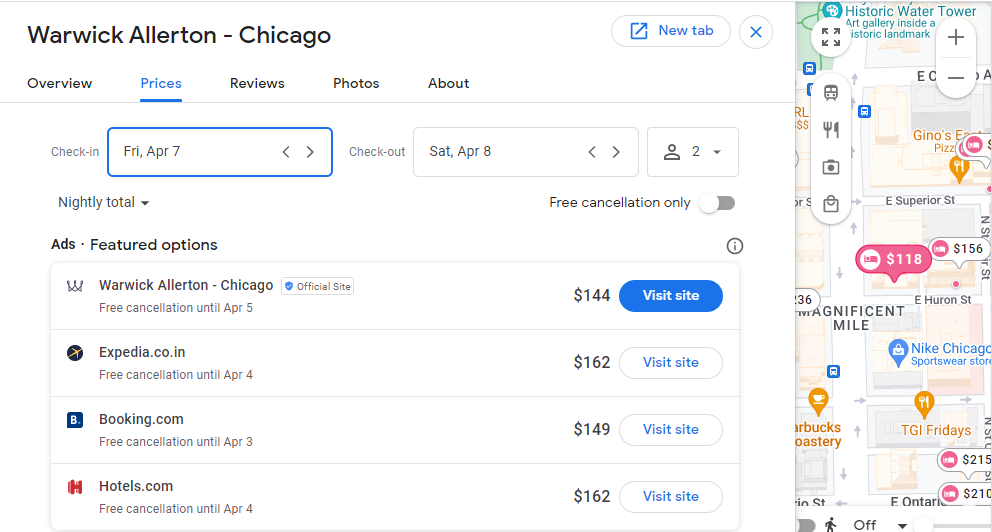

If you do a hotel search on Google, let’s say, Warwick Allerton, Chicago, you will see various options to book the hotel- both from the hotel and OTAs. Here, Google tags the hotel as an official site, so that travel shoppers can directly book from their website instead of choosing an OTA. So, Google here works as an intermediary and not an OTA.

Also Read – Predictive Market Intelligence: A Secret Weapon for Online Travel Agencies

So, what’s the threat?

OTAs are the preferred booking channel, and with the easy Google Hotel Search, there’s a risk of losing their position. Especially when the metasearch platform delivers a better user experience by making users stay on the same page for research, comparison and booking hotels, this makes it even tougher for OTAs to generate traffic to their website. While these booking platforms will not shut down, their value might scale down.

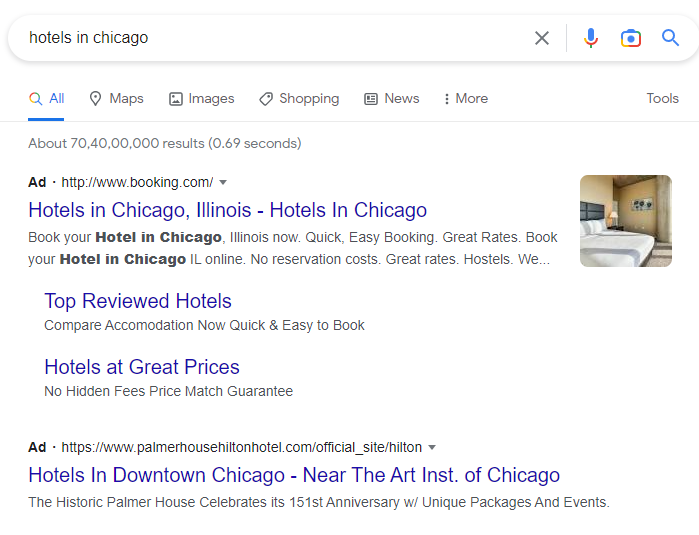

Booking channels like Expedia, Booking.com, TripAdvisor pay billions of dollars for ads to appear at the top of search results. Users are more likely to click the first result, driving more traffic to the website. Basically, OTAs heavily rely on Google for traffic. This traffic comes in the form of paid ads at the top of the page, and ironically, this is similar to how independent hotels rely upon OTAs to display their properties during the search.

In fact, Google is a crucial piece of any OTA’s advertising budget because so many travelers search for trips with terms like “flights to London” or “hotels in Chicago.”

While OTAs have expressed their interest in reducing their dependence on Google for website traffic, they can’t get away from the fact that it’s their paid ads on Google that drives maximum traffic. According to ResearchAndMarkets.com’s case study, Expedia garnered 1 million more visits from paid marketing with Google in March 2021 than it did in March 2019.

So what do we understand of Google’s stand to become an OTA? Google has to just add a feature Book Online and it is a step away from becoming an OTA. But Google doesn’t want to become an OTA and deal with inventory onboarding, hotel contracts, customer support, etc., because that doesn’t align with the company’s business goals. Google was to become the comprehensive search engine for the travel industry. It wants to give travel shoppers complete access to hotels, vacation rentals, and other travel products and capitalize on it. While it will continue to benefit from the paid ads, and organic search, it can be an intensively competitive area for all booking channels. However, it will be interesting to see if Google will continue to be the largest player in the travel market when social platforms like TikTok are giving tough competition to it through its visual travel discovery.