Unlike what was the norm a decade ago, online travel businesses like OTAs had to depend upon banks to process their payments. Things have drastically changed now that we have so many PSPs (, aka payment service providers), that OTAs have to do due diligence to pick one, and it has become one of the most important decisions they have to make.

As an OTA, you know you are an international business. Cross-border payments make things complex for you. But you cannot simply go with a PSP that provides the smoothest UX. When choosing a PSP, the biggest job is to protect your margins.

What are other factors that you must assess before taking a final call? We are going to discuss all of that in this piece. We will not be naming PSPs because what goes with your existing tech stack varies. So, we will cover everything you must expect from your payment service provider.

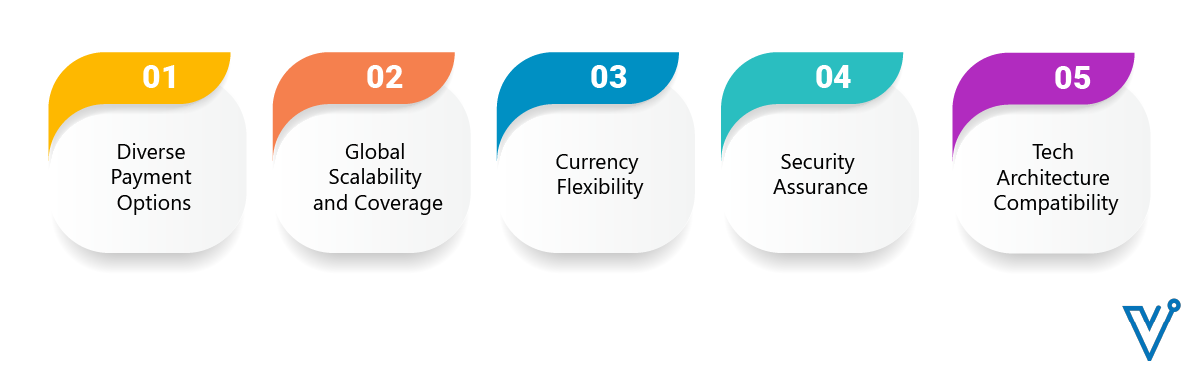

Five ways you should assess a PSP for your OTA

Diverse Payment Options

Once the be-all and end-all of all financial transactions, traditional bank transfers are less efficient than the many contemporary alternatives. As such, PSPs embrace innovative technologies and offer diverse payment options.

Payment technology has evolved in tandem with the rise of online and mobile commerce. Neglecting the preferences of your customers and suppliers can significantly limit your market reach. Particularly if your OTA maintains diverse international relationships, it’s imperative to collaborate with a PSP that aligns with regional requirements.

At a minimum, a robust card strategy is essential. Also, your PSP should offer almost all loan payment options. These methods are often favored in specific regions or countries, such as AliPay in China, Paypal in North America, E-wallets, or digital wallets, now integral to the payment landscape, so your PSP must offer them.

Read More – Setting legacy code objectives for OTAs

Global Scalability and Coverage

For an international OTA, managing cross-border payments is an inherent challenge. It’s imperative to ascertain the countries a PSP serves, its approach to facilitating cross-border transactions, its network affiliations, and its licenses.

Your PSP must have a comprehensive network of licenses, strategic partnerships, and banking relationships. This infrastructure enables seamless money transfers across over 190 countries and through 65 real-time corridors.

Currency Flexibility

PSPs must demonstrate adaptability in processing multiple currencies, a prerequisite for facilitating cross-border trade. It’s essential to consider the currencies pertinent to your current operations and those your business may require as it expands globally. Opt for providers that support a broad spectrum of currencies, ensuring your present and future needs are well accommodated.

Security Assurance

The digital payment ecosystem is also filled with opportunities for fraud, so the security of payments assumes paramount significance. You must ensure the chosen payment system adheres to industry certification standards and deploys robust end-to-end encryption. Pay special attention to compliance with the Payment Card Industry Data Security Standard (PCI DSS) to protect sensitive cardholder data.

Tech Architecture Compatibility

As you know, tech architecture compatibility has various facets, including onboarding, system integration, and ongoing support. Your collaboration with a PSP should guarantee top-tier service across these domains, offering swift onboarding, streamlined development processes, and comprehensive ongoing support.

Ideally, seek providers offering a REST API for maximum flexibility and control. Providers should enable you to construct global payment solutions via a RESTful methodology, ensuring straightforward integration, scalability, and platform reliability.

As you know, tech architecture compatibility has various facets, including onboarding, system integration, and ongoing support. Your collaboration with a PSP should guarantee top-tier service across these domains, offering swift onboarding, streamlined development processes, and comprehensive ongoing support.

Ideally, seek providers offering a REST API for maximum flexibility and control. Providers should enable you to construct global payment solutions via a RESTful methodology, ensuring straightforward integration, scalability, and platform reliability.